Congratulations to the 2023 Native CDFI Award Recipients

NACDC, based on the Blackfeet Reservation, received the 2023 Native CDFI Catalyst Award to build a trauma-informed financial services training program for employees of Native CDFIs. The training will help CDFIs better support clients who face money management challenges associated with historical trauma from the systemic stripping of land, culture, and Native heritage over centuries.

HLI received the 2023 Native CDFI Seed Capital Award for its food sovereignty strategy. As a result of colonization, Native Hawaiians have been disconnected from their language, culture, and food sources. Entire generations have lived without agricultural knowledge. The Seed Capital Award will help HLI develop products and services that promote agricultural expertise and experience among Native Hawaiians living on trust lands.

2022 Native CDFI Catalyst Award Recipient

Akiptan, Inc. is a certified Native CDFI that connects Native agricultural producers with capital and other resources they need to succeed. Based in Eagle Butte, South Dakota on the Cheyenne River Sioux Reservation, Akiptan has a national footprint and will use its Native CDFI Catalyst Award grant award to increase staff and develop new financial literacy tools for agricultural producers.

2022 Native CDFI Catalyst Award Recipient

Southeast Alaska-based Haa Yakaawu fosters self-sufficiency for tribal citizens and organizations through homeownership. With its Native CDFI Catalyst Award, the CDFI will expand a home loan package tailored to meet the needs of Native families. In a region where geography can be a barrier, Haa Yakaawu will build its mortgage loan pipeline by bringing in-person loan counseling and technical assistance to borrowers in small Alaskan villages..

2022 Native CDFI Seed Capital Award Recipient

Established in 2013, Nimiipuu Fund facilitates financial independence by enhancing the personal and entrepreneurial capacity of the Nez Perce Reservation and surrounding communities. Nimiipuu Fund earned the 2022 Seed Capital award for its strategy around a new Home Rehabilitation loan product. The offering will help mitigate a pervasive lack of affordable housing by enabling homebuyers to rehab existing available homes that are in poor condition.

2021 Native CDFI Catalyst Award Recipient

Northwest Native Development Fund (NNDF) in Coulee Dam, Washington, received the Native CDFI Catalyst Award for its strategy to address a severe lack of housing stock on and around the Colville reservation by rehabilitating existing houses and constructing new homes.

The Award will enable NNDF to fund, with matching funds, the management and construction of one home. With the proceeds from the sale of this home, the CDFI will build or rehab another home and so on, creating a self-funding, replicable process. The CDFI expects to solar power each home to offset the exorbitant cost of electricity on the Reservation. The CDFI will leverage its Catalyst Award to create a minimum of 10 new homes.

2021 Native CDFI Seed Capital Award Recipient

Spruce Root assists Southeast Alaska’s people and businesses to reach their full potential through loan capital and support services. Currently the only CDFI, public lender, or bank offering low-interest microloans in Southeast Alaska, Spruce Root launched a microloan program in early 2021. The CDFI plans to use its Native CDFI Seed Capital Award to deliver one-on-one technical assistance to start-up businesses and entrepreneurs and help support them in applying for the CDFI’s microloan program.

2020 Native CDFI Catalyst Award Recipient

Cook Inlet Lending Center (CILC) serves low- to moderate-income households that lack access to affordable financial products and services in the Cook Inlet region of Alaska. For Anchorage small businesses impacted by COVID-19, CILC has developed a business stabilization strategy — Survive-Adapt-Thrive — to help the businesses ride out the current recession. An innovative combination of flexible financial products and supportive services, Survive-Adapt-Thrive responds to the moment by providing access to affordable capital that small businesses need immediately and long term. The approach is designed for struggling small businesses that have the potential to recover and flourish and are owned by people of color, women, and Alaska Natives. CILC will use its Native Catalyst Award grant to build the staff capacity required to successfully implement its strategy.

2020 Native CDFI Seed Capital Award Recipient

Black Hills Community Loan Fund (BHCLF) creates financial opportunities for economically disadvantaged families who aim to strengthen their financial future in the Black Hills Region. BHCLF will use its Native CDFI Seed Capital Award to support Lakota, Dakota, and Nakota artists during this unprecedented time. Due to the pandemic, tribal artists are unable to sell their products through the usual venues like art festivals, pow-wows, and museums. BHCLF is collaborating with Native Pop, a local nonprofit Native arts market and cultural celebration, to help Black Hills artists modify their business plans to meet today’s needs for social distance. With its grant, BHCLF will purchase equipment and consulting services to assist artists in redeveloping their marketing plans and building new websites.

Native CDFI Catalyst Award Recipient

Four Directions Development Corporation (FDDC) Catalyst Award to help scale its new Community Development program. Found in 2001, FDDC’s mission is to improve social and economic conditions of Maine’s Wabanaki tribes — Maliseet, Micmac, Passamaquoddy, and Penobscot — through education and investment in affordable housing, tribal business ventures, and Native entrepreneurship.

Native CDFI Seed Capital Award Recipient

Lummi CDFI in Bellingham, Washington won a $25,000 grant to help launch its new peer-to-peer technical assistance program that will strengthen the capacity and skillsets of Native-owned businesses. Since its founding in 2006, the CDFI, which serves the Lummi Nation and surrounding Pacific Northwest region, has seen an increased need for technical assistance as a growing number of entrepreneurs are requesting help with accounting, record keeping, marketing, and more.

Caitlin Way (Tlingit) owns Fisheye Coffee, a drive-thru coffee shop in Sitka, Alaska, that provides wholesome food. The business’s growth was initially stifled by a restrictive family loan and an inability to obtain traditional financing. With a Spruce Root small business loan, Caitlin had the opportunity to explore her culinary skills and invest in her business — she recently paid off her loan in full.

There is a serious housing crisis on the Colville Indian Reservation. When quality homes exist, the prices outpace the salaries of local teachers, nurses, the office workers of the region. In 2019, the Northwest Native Development Fund decided enough was enough — it purchased a town lot and built a three-bedroom, two-bath home. The brand-new home was a perfect size and the price for a young family.

Michael and Charlotte Mulcahy utilized Cook Inlet Lending Center’s Individual Development Account (IDA) program, combined with the Native American Homeownership Initiative (NAHI) program for down payment assistance and a HUD184 mortgage to open the door to their dream of homeownership. These programs not only provide capital, they set clients up for successful homeownership with budgeting tools and homeownership education classes.

Darla Takes The Knife (Cheyenne River Lakota) is a skilled seamstress and worked as a tailor for several local military bases. During the COVID-19 pandemic, she pivoted her cut and sew shop to meet the needs of personal protection equipment (PPE) and began taking orders for masks. The demand was so great that she sews full-time to fulfill her ever growing contracts.

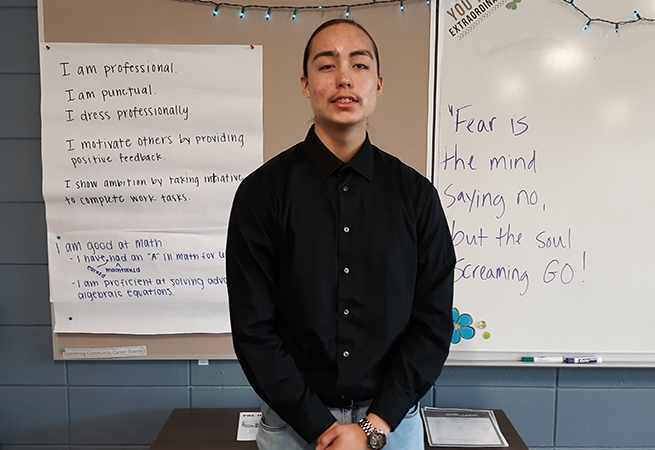

Devyn Valandra (Oglala Lakota) was a high school senior in Rapid City when he developed a coffee product infused with sage. He worked closely with Black Hills Community Loan Fund to create his business plan, build relationships with potential clients, develop a marketing plan, and ultimately become an entrepreneur.

Monique and Delaney were the recipients of Black Hills Community Loan Fund’s first down payment loan. Members of the Yankton Sioux and Oglala Sioux Tribe who work and reside in Rapid City, they purchased their new four-bedroom home in 2019.

Artist Calvin Francis, a member of the Penobscot Nation, is a longtime Four Directions client. When revered Penobscot elder Charles Shay, a WWII hero, moved to France, Charles asked Calvin to purchase and steward his home and preserve its history. Honored to be chosen, Calvin turned to Four Directions for help financing the purchase.

After graduating from the University of Maine, Awendela Dana was eager to buy a home in her Penobscot community on the Indian Island Reservation but wasn’t aware of any loan programs for buying on-reservation. Then she met Four Directions. In 2004, she received a Four Directions loan to purchase her single-family home. Since then, she has refinanced the mortgage and financed a roof repair with the CDFI’s help.

Owning a café was George and Cycy Guerrero’s dream. Lummi CDFI supported the couple from the earliest stages of starting a food truck and brick-and-mortar business, providing them with technical assistance and a loan.

Lummi CDFI helped Lummi-artist Bruce Pierre, a longtime client, open Salish Peoples Arts, a tribal business that sells Bruce’s personal designs. Over more than 10 years, the CDFI has offered him loans, coaching, and education and enabled Bruce to build his credit.